The CARS HYPE CYCLE

- Nils Willner

- Sep 14, 2022

- 8 min read

The average new car loses over 50% of its value in the first five years. Some models even depreciate faster than that. The Mercedes S-Class is arguably one of the best luxury cars you can buy, but that hasn't stopped it from depreciating almost 70% on average. You'll lose around $60k if you buy one new and hold it for 5 years. The biggest losers are luxury brands such as Maserati, BMW, Audi, Mercedes, Landrover and Cadillac. Buying top-end models from these brands will result in a 70% depreciation over the first few years of ownership. A steep depreciation is one of the reasons why you can often pick up a used luxury car for cents on the dollar just a few years later.

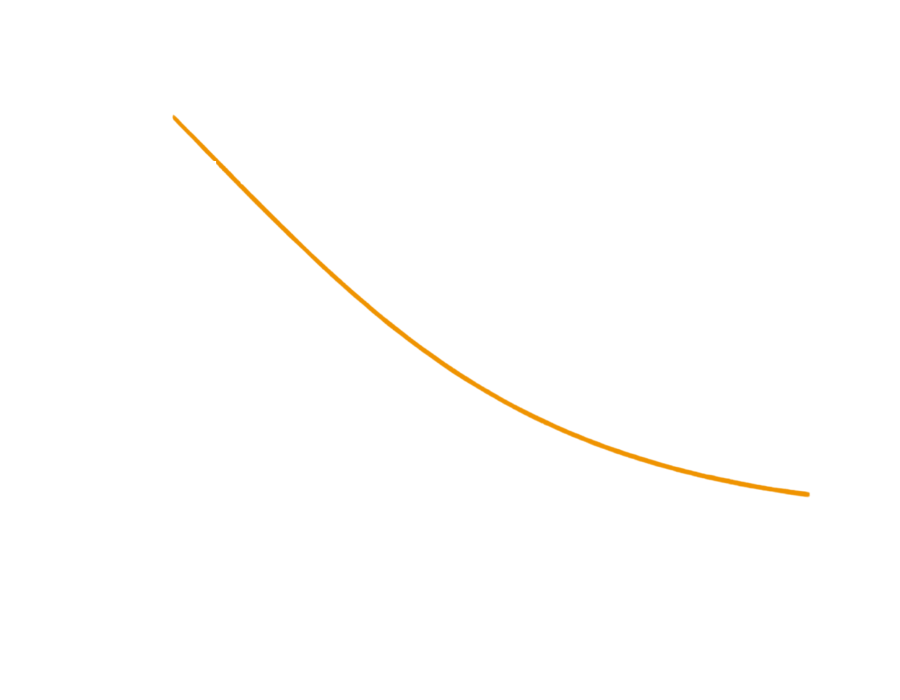

The Hype Cycle

Many cars go through a cycle of depreciation and appreciation related to time. There are 6 stages where a car loses or gains value. Note that this curve is only for illustration purposes and values can dramatically vary depending on the brand, model, numbers of units produced, speciality etc.

1. Depreciation: In the first 5 years, a car loses on average 50% of its value with luxury vehicles taking a hit of almost 70%. After 10 years, most cars run out of warranty and become the sole liability of the owner. A car is almost guaranteed to lose most of its value within the first 10 - 15 years. A Mercedes S500 W222 with an average age of 5 years trades between €40'000 - €65'000 depending on mileage. That is already 60% - 70% depreciation from its original MSPR of €110'000 - €140'000.

2. Decimation: After 10 - 20 years, cars enter the decimation phase where they almost lose their complete value and are often being scrapped and can be found in high numbers at scrap yards. This is often due to high mileage, neglect and repair accumulation. A good example is the BMW E30, which was a common sight at any scrap yard. The last owners don't do necessary maintenance or repair work anymore and drive them to their death. Performance and special edition models tend to hold some of their value because they are the top-of-the-line models of a specific lineup and enthusiasts are always looking for low-mileage, good example cars. The E55 AMG W211 is almost 20 years old but still costs around €18'000. High-mileage and bad-condition models are usually not very popular and will sell for considerably less.

3. Nostalgia: Once a car has reached 20-30 years of age, people who used to drive them when younger start to develop nostalgia. They remember the good times they had with their cars. Prices rise slowly because some want their old car back and they have now more disposable income to spend. A good example is the Mercedes 190E 2.3-16v which was the high-performance model of the 190E W201. The car only cost new around 26'000 Deutsche Mark and today's market price of €20'000 reflects the return of popularity originating from nostalgia.

4. Hype: Once a classic car model starts to rise in value, speculators, collectors and auction houses enter the picture and start driving up prices more and more. The car model starts to be advertised as a collector's car and a solid investment. This often leads to a hype where exorbitant amounts are paid. A good example is the Mercedes 300SL R107 which has been popular with collectors and classic car enthusiasts for a long time now. Nevertheless, it is a fairly overhyped car and Mercedes produced over 200'000 of it. The recent hype has already cooled off a bit with prices declining since people realised that it is that of a special car. Only the best and most pristine roadsters are sought after. Another example of a very hyped car is the BMW M3 E30 with some examples closing in on the $100k mark. BMW made almost 20'000 of these and a 6-figure market price is way beyond the value of the car. Nevertheless, many M3s have been wrecked or racked up high miles. Few good examples remain which trade at a very high premium.

5. Disbelief: As with any hype cycle, people will eventually question these exorbitant prices and there won't be another buyer who is willing to pay even more for this specific model. All enthusiasts have been priced out already and the market is left with only speculators and investors who buy cars solely because of their value and appreciation. Eventually, prices will decline again. A great example of an overhyped car is the Mercedes 190E 2.5-16 EVO II which was the competitor to the M3. It trades at prices which are on par with very exclusive super- and collectable cars. The exorbitant prices also come from a very limited supply of only 500 cars. Another example of an overhyped car is the BMW 3.0 CSL E9 "Batmobile" which got its wings already capped. Market prices are coming down again after a steep rush to the moon. The Batmobile is not as known with the younger generation car enthusiasts anymore, which thins out the demand. The new generation of car buyers is mostly interested in the 90s - 2000s models.

6. Collecting: After 50 years only a few really good original cars are left and they become scarce. Some cars are forgotten in garages because the owner has died and the family didn't know what to do with them. Often, they are then rediscovered, restored and then become part of a private collection or a museum. These cars won't be seen often anymore on roads and appear occasionally with reputable auction houses and classic car dealerships. Prices tend to stabilize and appreciate at a constant rate over the years. A good example is the Mercedes 300SL W198. Prices for this car are quite stable and it is a common agreement that the Gullwing is a solid investment which holds its value. These cars are well looked after and most of them were already professionally restored. They usually trade hands in the 7-figure range between wealthy collectors and exclusive and reputable auction houses. But not every car goes through this cycle though, some are just being forgotten because they are not noteworthy enough even if they have been produced in low numbers. Best example: The Ginetta G32 or the Simca 1000.

Why German Cars Depreciate Fast

It's always the German cars that seemingly depreciate the fastest and that feel like a really bad investment when buying them new. There are two main reasons for this:

No1: Most German cars sold (in the USA) are in the luxury category. Almost all luxury cars depreciate heavily. This is due to the fact that they are more expensive to begin with. Luxury cars are often priced higher due to the intangibles that come with a prestigious brand of owning a car from a desirable brand like BMW, Audi or Mercedes. For most people, the extra features and performance of a new luxury car aren’t worth the price difference over a basic car. But the gap normally comes from this: People who can afford to buy a new luxury car don't want to buy a secondhand one – and people who want to buy a secondhand luxury car can’t afford a new one.

No.2: German cars tend to be very unreliable when the warranty period expires. Manufacturers intentionally build in planned obsolescence which lets the car continuously break down after the warranty period so owners get fed up and buy a new car. Furthermore, the repairs needed tend to be much more costly than the same repair on economy vehicles. Luxury car manufacturers intentionally charge a lot of money for spare parts and repairs. That Mercedes S-class which you bought for €20'000 still causes repair bills which are on par with its retail price of €140'000. This usually means a total write-off and financial ruin for the person who can only afford a €20'000 car.

What about EV's?

Electric vehicle technology is developing quickly and new car models become obsolete just after a few years. A lot of EV models are not fully developed and have many teething problems. The battery pack today consist of lithium-ion battery cells which have an average life expectancy of 10 years. Since the battery is the most expensive part of an EV (€10k - €20k) the car becomes a total write-off just after 10 years. Most electric vehicles depreciate more quickly than non-EVs. This trend is likely to continue until EV technology plateaus. Technological leaps such as battery capacity, range, price and quality will be smaller and smaller. Once this has happened resale prices will be more solid. Most recently EV's have been quite stable in their value, but that is due to the pandemic, the ongoing supply chain issues and the new car shortage. Manufacturers can't keep up with demand and supply is at an all-time low. This means that prices for used vehicles also go up. Combined with exorbitant fuel prices, a used EV seems to be a great buy. Most EV's have not reached their 10-year end of life but the time will soon come when we will see a lot of cheap EVs with many of them piling up at scrapyards.

Cars as Investment

So is it possible to have a car as an investment? Yes, but there are a few limitations and risks you have to consider. There are 4 main factors to watch out for when investing in a car:

1. Collectible: A car needs to have a collectible status to be recognised as a solid investment. This usually means that it has a racing history or any other special status.

2. Scarce: The car should be scarce and not have been produced in huge quantities. Often, special edition or homologation specials came in limited production numbers. But it can also be the case that many existing cars got scrapped which decimated the supply.

3. Demand: The car should be widely known by car fans and enthusiasts. There should be a healthy demand so that there are enough bidders for a car to establish a solid market price.

4. Condition: A great condition with low mileage is key for any car to be seen as an investment. High mileage cars in bad condition will often be considerably less valuable and more prone to heavy price fluctuations whereas cars in collectible condition tend to keep their value on a high level. This usually also means that the car shouldn't be used as a daily driver if you want to preserve its condition and value.

Investing and collecting classic cars falls into the same category as any other collectable and scarce assets such as paintings, antique furniture or watches. A scarce, unique, and universally identifiable item like a painting or classic car can be an extremely value-dense and mobile asset. It doesn't need to be taxed, it can be relocated anywhere in the world quickly, and it can be liquidated pretty fast to generate cash flow when needed. Imagine a Rolex watch with a value of $1M. You wear it on your wrist, and if the revenue authorities show up, you just fly to another country and liquidate it there. You could put all your life savings into this asset and just wear it on your wrist without being under the scrutiny of any tax authority or government. They can't seize it or take it from you, and its value is very stable and without drastic risks (if it's universally recognized and collected).

Liability vs Asset

I'd estimate that a classic car becomes an asset at a price beyond >$100k. If you buy a car below $100k, you have to pay for maintenance, repairs, storage, insurance, road taxes etc. The sum of these recurring expenses will outweigh the appreciation, and you are losing money. This means the car is a liability and not an asset. The running cost of a widely recognised classic car such as the Jaguar E-Type, which can trade well above $100k, will become negligible and the appreciation will continue to absorb the costs. You’ll spend $5k annually on repairs and maintenance, but the car will appreciate by $10k every year (+10%). A classic car worth above this threshold can be mainly seen as an investment and not as a liability. The precondition is that the car won't be driven much.

If you want to learn more about how to buy a classic car and what to look out for, consider our book:

Nils Willner

Nils is a Swiss-German engineer who is obsessed with old cars and engines. He is the author of "The Ultimate Classic Car Guide - How to Buy, Maintain & Repair Classic Cars" and the founder of EVC. His passion has always been with old cars and everything with wheels and engines.

Comments